Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Smart Start Investing

66 members • Free

Contributions

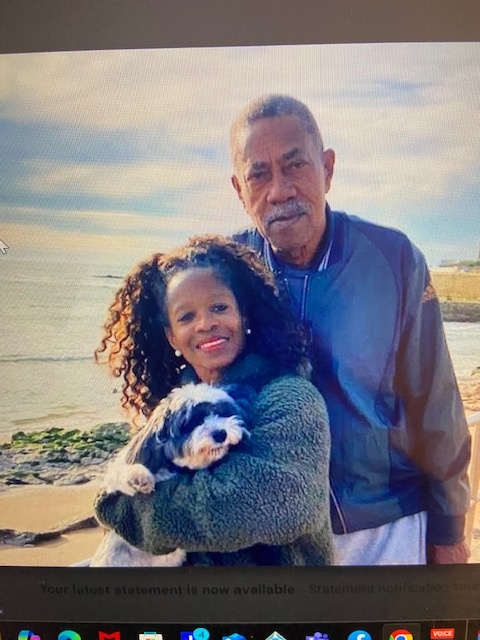

@gladys-imani-leonard-funderburk-1528

We are both from Atlanta. We are grandparents with eight grandkids. Can we still achieve wealth building even though we're in retirement?

Active 71d ago

Joined Jan 11, 2025

Powered by