Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The Portugal Club (50+ Life)

255 members • Free

19 contributions to The Portugal Club (50+ Life)

Thursday, Quinta, 8th May, 2025: Current & Currency?

Olá bom dia alegria! Tudo bem? Munson's Midday Moment is back, and feeling good! See you at Noon, Portugal time, for a bit of peace and calm? Check it out LIVE on the YouTube channel. I'll be recording this morning with another Carl, not @Carl Hyde, but Carl McAdam, who's been experimenting an with off-grid, electrical kit, in Central Portugal. The Currency Coach @Sarah Davie also in the studio, celebrating a year in Portugal, and updating us on the money markets. We will be looking at the SpartanFX rates. Join me for both recording sessions, 8.20 & 8.40, and ask your own questions, on this link. A slightly slow start for me this morning after a pleasant evening with the lads at my local Men's Shed, but I still beat the dawn at around 6.31. Sunset at around 20:35 tonight, with the days still 'getting longer'. Yesterday lunchtime saw a very pleasant meetup too with a good mix of new and familiar faces in São Martino Do Porto. Continuing on the district tour, and on to Faro, where there's a 40% chance of rain today! That's according to IPMA, who are suggesting a low there of 11°C/52°F and a high of 20°C/70°F, with some sunshine in the early evening after a rainy day. QUIZ: What were @Sarah Davie and her dad doing in the pics, attached?! ***NO birds or nests harmed in the making of...***

Poll

4 members have voted

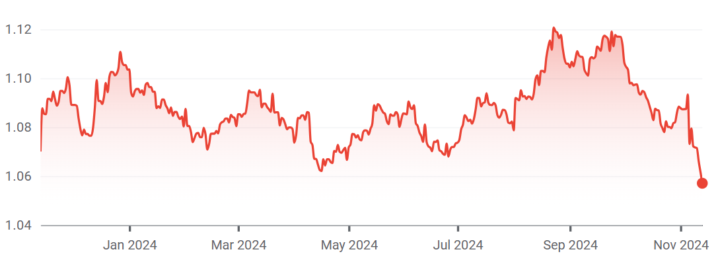

Biggest U.S Dollar sell off in 2 years

The U.S. dollar saw its largest sell-off against the euro in over two years, dropping 4% in a single week as concerns over Trump’s tariffs and broader geopolitical policies rattled markets. The effects of these tariffs are already being felt by businesses and consumers alike. It remains to be seen if, and how quickly, these policies will be reversed.A key driver of recent euro strength is the shift in U.S. foreign policy, particularly its stance on Ukraine, which has accelerated defence spending across Europe. The EU has committed an additional €800 billion to strengthening its defences, and Germany has eased fiscal constraints to allow for a significant increase in government spending. On Thursday, the European Central Bank (ECB) cut interest rates by 0.25%, but as this move was widely expected, the exchange rate remained largely unaffected. However, market sentiment toward the Eurozone has improved due to Germany and the European Commission’s investment commitments. Many analysts are now revising their EUR/USD forecasts upward, signalling a stronger outlook for the euro.With these developments in mind, it seems likely that the days of EUR/USD trading between 1.00 and 1.05 are behind us. If the U.S. job market continues to weaken, if tariffs drive up consumer prices, and if businesses hesitate to invest due to uncertainty around future U.S. economic policies, further USD weakness is likely.The only certainty at the moment seems to be volatility. The 4% move in EUR/USD last week faced little resistance, indicating that markets may be positioning for a more prolonged dollar sell-off. A 4% move in monetary terms has made €250,000 nearly $11,000 more expensive to purchase. To mitigate risks, tools like market orders, stop losses, and forward contracts are essential for managing against potential currency swings. Acting strategically in this environment is key to securing favourable rates and protecting against sudden market shifts. We recognise that clients have different risk appetites, and our role is to build an FX strategy tailored to those needs. The highest-risk approach is not having a strategy at all.

3

0

GMP! celebrates FIVE years! What are YOUR favourite moments?

We are celebrating five years on air! Please let us know what your favourite moments have been since we started in 2020...

Its nearly $10,000 cheaper to buy €250,000 euros since before the election.

Yesterday, data showed that US inflation for October increased in line with expectations, suggesting that the Federal Reserve (Fed) will keep cutting rates. The recent slip of the euro against the dollar is influenced by current US and European political developments. The market’s heightened sensitivity reflects the uncertainty surrounding the Fed’s policies, inflationary pressures, and the so-called “Trump trade,” which refers to the economic reactions to anticipated policies under Donald Trump’s administration. Broader Economic Outlook The Fed's stance on interest rates and inflation remains crucial to market behaviour. If inflation continues to trend above target, the Fed may respond with higher interest rates, potentially making the dollar more attractive. However, if Trump influences lower interest rate policies or the Fed signals future rate cuts, this could add volatility to the dollar’s strength, especially if combined with an economic stimulus agenda that increases fiscal spending. Given current conditions, selling US dollars and buying euros remains appealing, particularly with the recent exchange rate shifts. However, there is always a chance of reversal. Factors such as potential policy adjustments by the Fed, inflation trends, and the uncertainty surrounding Trump’s economic stance could quickly alter the currency landscape. We are here to help you manage exposure to potential exchange rate movements. If you want any certainty with your currency exchange, feel free to contact us and we can explain all of the options available to you. Email: [email protected]

0

0

Trump wins the US election and US dollar strengths by 2% against the euro

Trump wins the US election and US dollar strengths by 2% against the euro. In one day it became nearly $6,000 cheaper to buy €250,000. Going forward what could this mean for the US Dollar? This victory could have a significant impact on the US dollar, depending on the expectations for his policies and the broader economic outlook. Here are some possible effects: 1. Pro-Business and Tax Policies: - Strengthening the Dollar: Trump's policies have often been perceived as pro-business, especially with tax cuts and deregulation. Such measures could stimulate economic growth and attract foreign investment, which tends to strengthen the US dollar. In 2017, the dollar saw initial strength following the passage of tax reforms under his administration. - Deficit Concerns: On the flip side, Trump’s proposals to increase government spending (especially in defense and infrastructure) without corresponding tax hikes could lead to concerns about higher fiscal deficits. This could put downward pressure on the dollar if investors perceive this as unsustainable. 2. Trade and Global Relations: - Trade Wars or Agreements: Trump's "America First" stance has led to trade tensions, particularly with China. While this could lead to short-term volatility, some market participants believe that a Trump victory could lead to more favourable trade agreements or a de-escalation of tensions, potentially boosting confidence in the dollar. - Global Uncertainty: Trump's unpredictable style and frequent use of tariffs could contribute to global economic uncertainty, which might cause investors to seek the US dollar as a "safe haven" asset, boosting its value. 3. Monetary Policy Expectations: - Impact on the Federal Reserve: Trump continues to advocate for lower interest rates, it could influence the Federal Reserve's stance on monetary policy. 4. Investor Sentiment and Global Stability: - Volatility: Markets tend to react to political uncertainty, this victory could lead to short-term volatility, especially if it results in a shift in policy or an unexpected event. In such cases, the dollar might experience fluctuations as investors adjust their expectations for US economic and political stability.

1-10 of 19

@sarah-davie-6051

Currency Expert - helping people to save time and money, whether you are buying a property, paying fees, or transferring money to your local account.

Active 276d ago

Joined Apr 13, 2023