Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Online Business Friends

86.8k members • Free

Pocket Singers Free

16.4k members • Free

Wealth University

3k members • Free

Big Dream Fuel

130 members • Free

Automated Cleaning Business

1.8k members • Free

Self-reliant Homestead Living

270 members • $5/month

Elite Sales Alliance

21.9k members • Free

Wholesaling Real Estate

3.2k members • Free

Creator Profits (Free)

17.5k members • Free

Contributions

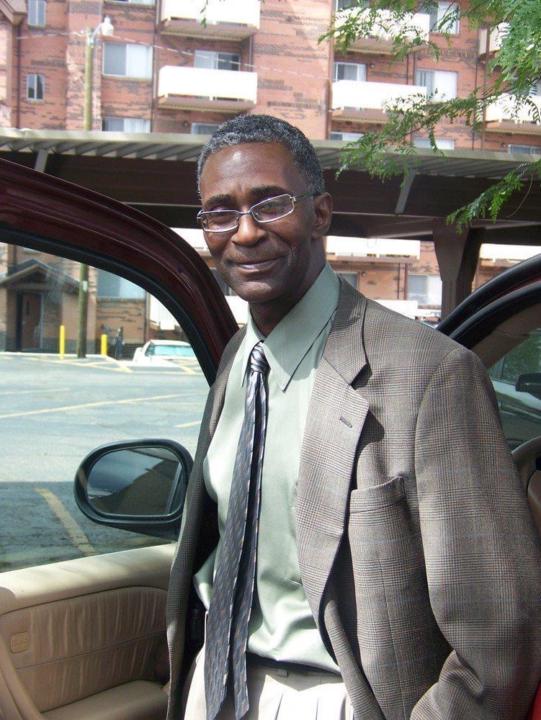

@chip-bridge-1792

I am a trusted lender providing fast, reliable funding for real estate and business deals.

Active 8d ago

Joined Nov 20, 2025

Powered by