Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

(Free) Canadian Real Estate

1.1k members • Free

Canadian Real Estate Investing

161 members • $70/m

10 contributions to (Free) Canadian Real Estate

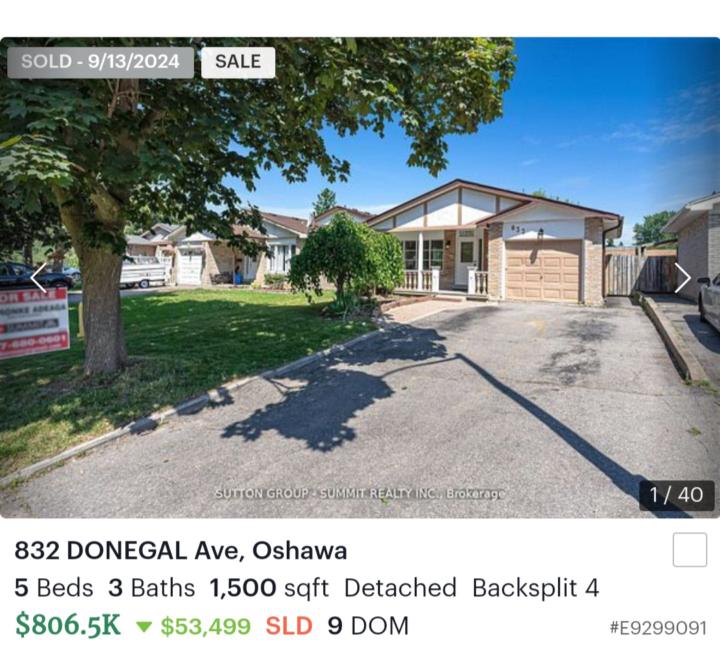

RECENT SOLD 2 UNITS Homes in Oshawa

Check out these duplex/2 unit home that all sold for around 800k. With 20% down and 4.5% mortgage rate there is potential for decent cash flow. Has anyone here considered Oshawa as an investment or has invested in Oshawa. ?

Downtown Toronto coffee chat?

Anyone in Toronto whose planning to buy their first investment property in the next year or so want to grab a coffee and chat? I have one property outside the country and looking to buy my first in Canada in 12 months. That's where I'm at and I'd love to connect. Share goals and strategy. I live and work downtown Toronto. Send me a DM or comment below.

Challenge Draw Winner...🥁

Thank you to everyone who joined the challenge, attended the calls, and contributed to the group over the past week! We hope many more people take the time to watch the recordings, complete the homework, and manage to take huge action towards finding deals that make sense in any market. With the being said, we must give a special thanks to everyone who completed all 5 days of the homework tasks. There were 13 of you specifically, and your names were all assigned a number, and then set up in a random number generator for a chance to win free access into our full paid course, coaching group, & community. And the winner is.... @Sarah Roe Congratulations Sarah, we will be in touch shortly to arrange your access into the full program!!! 🎉 We would also like to extend a special shout out to @Jeff Drake for being the ultimate hype man and resident group energy booster. Jeff I'll be reaching out to you shortly to chat as well about a special consolation prize. To everyone else who contributed, thank you so much and we hope to continue to relationship - this is only the beginning. For everyone else who is joining now and missed the live version of the challenge, our intention is to continue to grow this community and have others come in and kickstart their analysis through these videos and homework assignments. Dan and Nick will be jumping in this group for periodic live webinars and dropping new content from time to time, so we'll plan to connect with you all again soon. For any of you who are interested in learning more about our full program that offers weekly coaching, 20+ hours of video course materials and growing, and much more, you can DM me, @Nick Hill, or @Daniel Foch on this platform, or just go straight to this link to learn more and book a call with us. https://www.realist.ca/what-is-realist-dan

Day 5 Homework

Thanks for a great week anyone. Homework for day 5 - (due monday) 1. Calculate cash on cash return for your remaining properties 2. Build a 10-year proforma model from scratch for one investment 3. Calculate annual cash-on-cash return for 10-years 4. Create a rough 1-pager promoting your deal (include photo, metrics, profroma screenshot, and any other key points) Post 1-pager below in the comments. We will pull one random 1-pager to select a winner on Monday!

2 likes • Mar '24

Great course and I have learned A LOT. Looking forward to playing with the numbers over the next few days to get a better sense of how the different variables will affect a deal. I wanted the Hamilton property to work because of the Victorian fireplace. But it ended up being this Windsor property that worked well.

Day 4 Homework

Thanks for a great live session today everyone. Today's homework is: 1. Contact the local credit union in the market you're searching, and see if they can give you a Debt Service Coverage Ratio (DSCR) and Loan-to-value (LTV) parameter for what they'd loan to you for an investment property. (If you can't reach them, just use 1.25 DSCR) 2. Calculate the DSCR for 3 of the listings on your shortlist. 3. Highlight a deal if it hits the DSCR criteria of the lender. Please post a screenshot of #2 and comment "DONE" in this thread.

1-10 of 10